Understanding your credit score is essential for navigating today’s financial world. Whether you want to apply for a loan, secure a mortgage, get the best interest rates, or even qualify for insurance, your credit score plays a critical role in determining your eligibility. This guide will explore the different credit score ranges, what they mean, and how you can improve your score to reach financial success.

What Is a Credit Score?

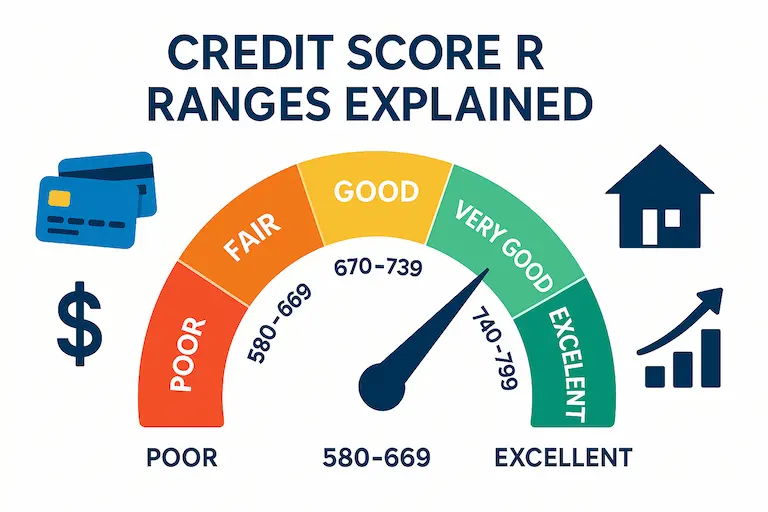

A credit score is a three-digit number that summarizes your creditworthiness. It is based on your credit history, including accounts, payment history, debt levels, and more. The most common credit scoring models are FICO and VantageScore, and their ranges typically fall between 300 and 850.

Credit Score Ranges Explained

| Credit Score Range | Rating | Meaning |

|---|---|---|

| 300–579 | Poor | High risk to lenders; often denied credit |

| 580–669 | Fair | Subprime borrowers; limited loan options |

| 670–739 | Good | Acceptable by most lenders; better rates available |

| 740–799 | Very Good | Qualify for favorable terms and interest rates |

| 800–850 | Excellent | Access to the best financial products and low rates |

Why Your Credit Score Matters

- Loan Approval: Lenders use your score to decide whether to approve your loan or credit application.

- Interest Rates: Higher scores lead to lower rates on loans, saving you thousands over time.

- Insurance Premiums: Insurers may charge higher premiums to individuals with low scores.

- Employment Opportunities: Some employers check credit scores when hiring, especially for financial roles.

- Business Credit: If you own a business, your personal score can impact your ability to get business credit cards or loans.

Key Factors That Impact Your Credit Score

- Payment History (35%)

- Consistently making on-time payments on credit cards and loans boosts your score.

- Credit Utilization (30%)

- Keep your credit card balances below 30% of the available limit.

- Length of Credit History (15%)

- Older accounts improve your score by showing a longer track record of managing credit.

- New Credit (10%)

- Opening many new accounts in a short time can negatively affect your score.

- Credit Mix (10%)

- A variety of credit types (loans, credit cards, mortgages) can strengthen your score.

Common Types of Credit Accounts

- Credit Cards: Revolving accounts with variable rates.

- Auto Loans: Installment loans used to purchase vehicles.

- Mortgages: Long-term installment loans for real estate.

- Student Loans: Education-focused installment loans.

- Business Loans and Cards: For commercial use and growth capital.

How to Improve Your Credit Score

- Pay Bills on Time: Automate payments to avoid late fees.

- Reduce Debt: Focus on paying down high-interest credit card balances.

- Avoid New Debt: Don’t open unnecessary new accounts.

- Dispute Errors: Check your credit report for mistakes and dispute inaccuracies.

- Increase Limits: Request higher credit limits to reduce utilization ratio.

Tools for Monitoring and Building Credit

- Free Credit Reports from AnnualCreditReport.com

- Credit Monitoring Apps like Credit Karma and Credit Sesame

- Secured Credit Cards to build or rebuild credit

- Personal Loans designed for credit building

Real-Life Examples

- Emily: Raised her score from 540 to 720 in 18 months by paying down debt and becoming an authorized user on her husband’s card.

- James: Disputed a collection account and gained 60 points in 45 days.

Reference Book Recommendation

A highly recommended resource to fully understand and master your credit is:

“Your Score: An Insider’s Secrets to Understanding, Controlling, and Protecting Your Credit Score”

Available on Amazon: https://amzn.to/3FpSYSV

Amazon Prices:

- Kindle: $0.00 (with Kindle Unlimited) or $8.92 to buy

- Audiobook: $0.00 (with Audible trial)

- Hardcover: $2.35

- Paperback: $8.92

This book dives deeper into credit myths, insider tips, and proven strategies to help you take control of your financial future.

Conclusion

Improving your credit score isn’t a sprint—it’s a marathon. By understanding the credit score ranges and what impacts your score, you can take actionable steps to improve your financial standing. The difference between a good and excellent score could mean lower interest rates, better insurance premiums, and even more job opportunities. Start managing your personal and business finances wisely today and enjoy the long-term rewards of a strong credit profile.