Updated: May 26, 2025 | By InvestinZone Team

Understanding student loan interest rates is crucial in 2025 if you’re planning to finance your education. These rates directly influence how much you’ll repay over time. Fortunately, with the right information, you can compare options and choose the best one for your financial situation.

In this updated guide, we’ll break down everything you need to know about federal and private student loan interest rates, how they’re determined, and how to reduce what you pay. Whether you’re applying for the first time or refinancing an existing loan, this resource will help you make smart decisions and potentially save thousands.

🔍 What Are Student Loan Interest Rates?

In simple terms, a student loan interest rate is the cost of borrowing money, expressed as a percentage of the loan amount. As a result, it determines how much you’ll ultimately pay in addition to the amount borrowed.

There are two types of interest rates:

- Federal: Set annually by the U.S. government.

- Private: Set by individual lenders based on credit history, income, and market trends.

While federal loans are more predictable, private loans may offer lower initial rates under certain conditions.

🏦 Federal vs. Private Student Loan Rates in 2025

Let’s take a closer look at how these two types of loans compare:

| Feature | Federal Loans | Private Loans |

|---|---|---|

| Who sets the rate? | U.S. Congress | Private lenders |

| Rate type | Fixed | Fixed or Variable |

| Credit check required? | No | Yes |

| Forgiveness options? | Yes (PSLF, IDR plans) | No |

| Interest rate range (2025) | 5.50% – 8.05% | 4.25% – 14.00%+ |

As you can see, federal loans offer more protections, while private loans require stronger credit and income credentials.

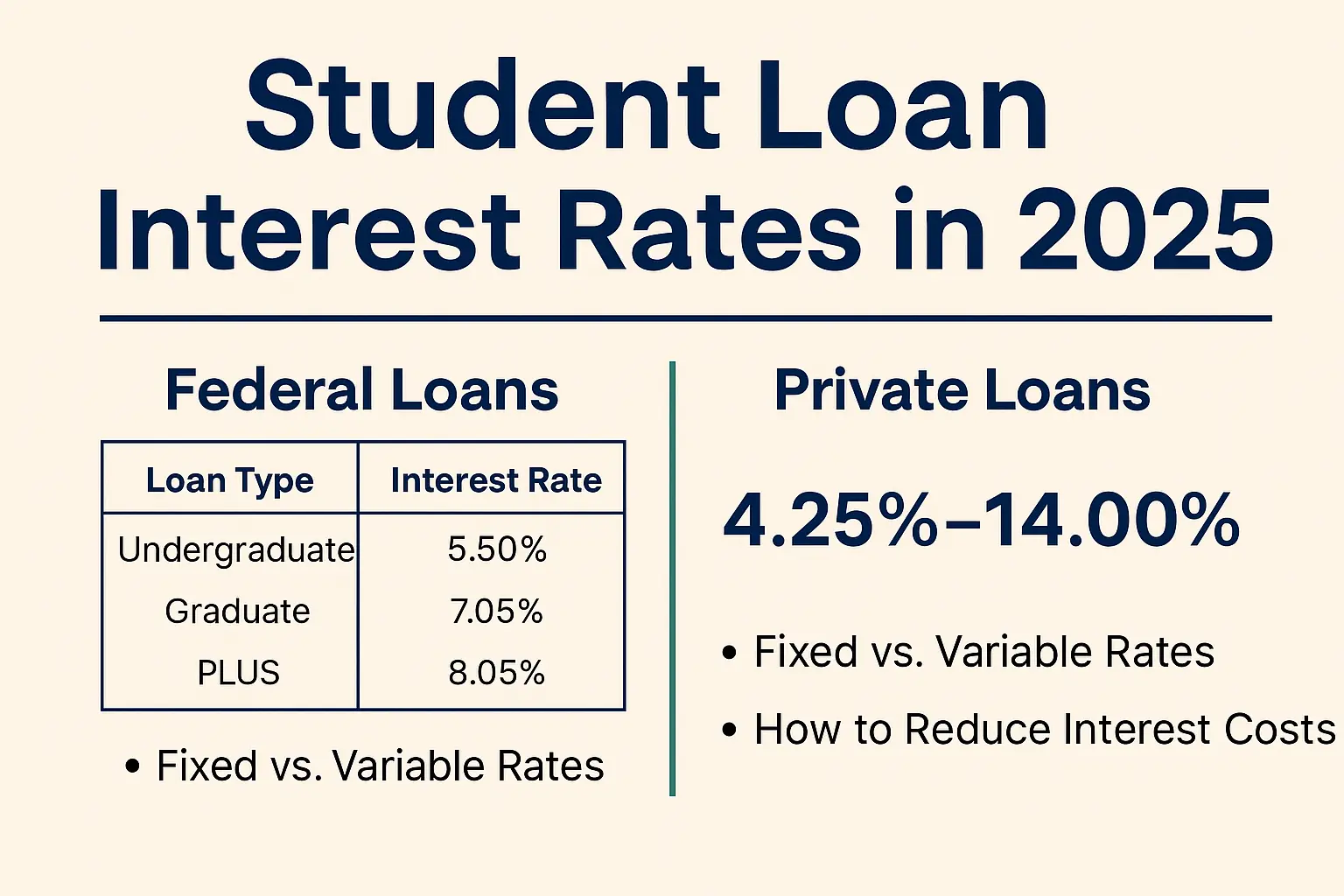

📈 Federal Student Loan Interest Rates (2025)

The U.S. Department of Education sets federal student loan rates every July. For the 2025–2026 academic year:

| Loan Type | Interest Rate |

|---|---|

| Direct Subsidized (Undergrad) | 5.50% |

| Direct Unsubsidized (Undergrad) | 5.50% |

| Direct Unsubsidized (Graduate) | 7.05% |

| Direct PLUS (Graduate/Parent) | 8.05% |

These rates remain fixed for the life of the loan, which makes budgeting easier.

🏦 Private Student Loan Interest Rates (2025)

Private loan interest rates vary widely by lender and borrower profile. In 2025:

| Lender | Fixed APR | Variable APR |

|---|---|---|

| Sallie Mae | 4.75%–13.99% | 4.25%–13.25% |

| SoFi | 5.49%–11.76% | 4.99%–12.99% |

| Earnest | 5.34%–12.78% | 4.89%–13.50% |

| Discover | 6.24%–13.99% | N/A |

Borrowers with excellent credit—or a qualified cosigner—can access the lowest rates.

⚖️ Fixed vs. Variable Rates

Fixed rates stay constant for the loan’s term, making budgeting easier. Variable rates change over time and are tied to market indexes like SOFR.

In 2025, fixed rates are safer for most students due to inflation risks and potential rate hikes.

💰 How Are Interest Rates Calculated?

- Federal: Based on the 10-Year Treasury Note + a fixed margin.

- Private: Determined by your credit score, income, school, and lender formula.

A strong financial profile = lower interest rates.

🚀 How Interest Affects Repayment

Consider this scenario:

- Loan: $20,000

- Interest: 6.8%

- Term: 10 years

Your monthly payment would be approximately $230, and you’d pay over $7,600 in interest. The lower the rate, the less you’ll repay.

🧬 Tips to Reduce Student Loan Interest Costs

- Pay interest while in school (if possible).

- Use auto-pay for interest rate discounts.

- Apply with a cosigner if your credit is limited.

- Make extra payments toward the principal.

- Consider refinancing after graduation.

📊 Comparison Table

| Feature | Federal Loan | Private Loan |

|---|---|---|

| Fixed Interest | ✅ | ✅ Optional |

| Variable Interest | ❌ | ✅ Available |

| Forgiveness Options | ✅ PSLF, IDR | ❌ |

| Interest Rates (2025) | 5.5% to 8.05% | 4.25% to 14%+ |

| Subsidized Option | ✅ Available | ❌ |

| Cosigner Required | ❌ | ✅ Often Required |

| Credit Check | ❌ | ✅ |

🤔 FAQs

Can I get a student loan without credit?

Yes. Federal student loans do not require credit. Private loans usually require a cosigner.

Are student loan interest rates fixed?

Federal loans are fixed. Private loans can be fixed or variable.

Is refinancing a good idea?

Only if you’re not eligible for forgiveness programs and can qualify for a better rate.

Will student loan interest rates rise?

Possibly. Rates depend on inflation and Federal Reserve policies.

🔗 References

- U.S. Department of Education: https://studentaid.gov

- NerdWallet Loan Comparison: https://www.nerdwallet.com

- Sallie Mae: https://www.salliemae.com

- SoFi: https://www.sofi.com/student-loans

- Earnest: https://www.earnest.com

- Discover Loans: https://www.discover.com/student-loans

Also read: How to Apply for Student Loans

Check our tools: Student Loan Calculators

Related guide: Best Student Credit Cards with No Credit History

Ready to compare your options and save money? Stay informed, choose wisely, and manage your student loans with confidence in 2025.

This breakdown of federal vs. private loan rates is insightful! I like how it emphasizes the stability of federal loans, especially for long-term planning. However, I wonder if private loans are worth the risk for those with excellent credit—what’s your take? The mention of inflation risks and potential rate hikes in 2025 makes fixed rates sound like the safer bet, but could variable rates still work for short-term loans? Also, the example of paying $7,600 in interest is eye-opening—does refinancing ever make sense to lower that? Lastly, do you think the government should do more to make federal loans even more competitive? Would love to hear your thoughts!

This comparison between federal and private loans is really helpful, especially for someone like me who’s trying to figure out the best way to finance education. I appreciate how federal loans offer stability with fixed rates, but I’m curious—what happens if someone’s financial situation changes drastically after taking out a private loan? The point about strong credit or a cosigner lowering rates is interesting, but not everyone has that option. Do you think lenders should consider other factors besides credit scores? The example of paying $7,600 in interest is alarming—are there strategies to avoid paying that much? And lastly, with inflation risks in 2025, do you think variable rates are worth considering at all? Would love to hear your perspective!

Thank you for your thoughtful comment and for raising excellent points!

If someone’s financial situation changes after taking out a private loan, options can vary depending on the lender. Some lenders offer hardship forbearance or repayment flexibility, but it’s less standardized than with federal loans. That’s why it’s crucial to ask about these policies *before* signing.

You’re absolutely right—relying solely on credit scores doesn’t always reflect someone’s true ability to repay. It would be great if more lenders considered income trends, employment history, or education background in their evaluations.

To avoid paying excessive interest like the $7,600 example, strategies include:

– Making extra payments toward the principal early.

– Choosing shorter loan terms (even if payments are higher).

– Refinancing once your credit improves.

As for variable rates in 2025: they *might* offer savings upfront, but with inflation and rate hikes still a concern, many borrowers prefer fixed rates for peace of mind.

Thanks again for engaging with the topic—we love smart questions like yours!